- Free Consultation: (907) 277-3090 Tap Here to Call Us

Umbrella Insurance Policies

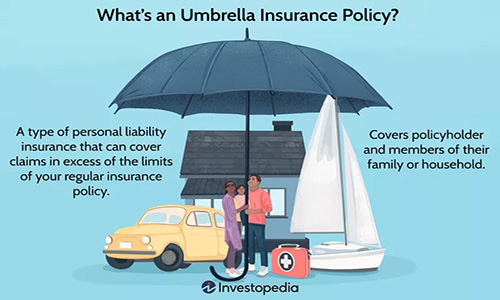

Umbrella insurance is not common in discussions but is beneficial by adding a layer of protection to meet insurance needs. Umbrella insurance coverage is a secondary layer of insurance and acts like an “umbrella” to protect you and injured parties. The coverage is in addition to other insurance like auto, renter, and homeowner insurances.

Umbrella Insurance Adds Liability Protection.

If you are in a situation where you are liable for someone’s injuries and claims, an umbrella policy is beneficial. After using all available primary insurance coverage, the umbrella policy kicks in to protect you and your assets from excess liability. That means if someone suffers injuries due to your actions, the umbrella policy helps take care of the injured party beyond your primary insurance limits. Additionally, the insurance protects your assets from liability claims and/or lawsuits.

Umbrella insurance helps with excess damages. If you suffer severe injuries due to someone else’s negligence, ensure your attorney asks about umbrella coverage on the at-fault party. For example, you are in a car accident suffering severe injuries and there is not enough auto insurance to cover your medical bills and claims. An experienced attorney will conduct research for umbrella coverage on the at-fault party. The additional insurance can be helpful recover losses due to the accident.

Ways it will help with other claims.

In addition to liability protection, umbrella coverage may help with “legal fees, false arrest, libel, and slander“. The coverage can be helpful to protect you in the event of a lawsuit. Adding the coverage to your insurance will help injured parties in case of serious accidents. It is important to plan ahead in case of an accident.

Combined with your home and auto insurance policies, an umbrella insurance policy is another layer of protection. Further, it may help during a lawsuit from driving or operating a rental. In addition, an umbrella policy may help if you’re sued.

What Is Umbrella Insurance?

Think of umbrella insurance -or personal liability insurance – as a safety net. Because, if you’re sued for damages that exceed the liability limits of your car insurance, homeowners insurance, boat insurance or other policies, an umbrella policy helps pay what you owe.

Umbrellas Insurance Start Where Other Policies Stop

Most Umbrella Policies sell in increments of $1 million. Umbrella insurance costs about $150 to $350 a year for the first $1 million of coverage and about $100 per million of coverage above that. The cost depends on where you live. Rates vary by state. Also, the number of homes, cars and boats you insure is equally important.

Is Buying An Umbrella Insurance Policy Necessary?

Do you need an umbrella insurance policy? Because Umbrella insurance isn’t required by law, it is most often purchased by people who have a lot of assets to protect or a high chance of being sued. The more you want to protect, the more insurance you want to buy. Follow the four steps below to learn more and obtain an umbrella policy to protect you if things go wrong.

- First, talk to your insurance agent. Before selling an Umbrella policy, insurers require a liability homeowner and auto policy.

- Second, learn about minimums: Homeowners is usually $300,000. Auto insurance is usually, $250,000 for injury to each person and $500,000 per accident.

- Third, look at the bottom line: Insurance companies often limit home and auto liability policies to $500,000 or $1 million. Adding more policies costs more money.

- Finally, compare numbers: It’s usually less expensive to buy an umbrella policy than to increase liability policies beyond the minimum required by your insurer.

This Blog is Part 4 of a 5 Part Series. Check these posts for information about Liability, U/UIM, Medical Payments, and Homeowner Insurance.

Johnson Law, P.C. has been helping Alaskans for nearly 30 years. It’s who we are. And while we hope you never need us… We’re here if you do. ~ Doug Johnson

Please call Johnson Law, P.C. to discuss your case: (907)277-3090 or use our online contact form.

Sources: Kiplinger; Nerdwallet; Trusted Choice; The Balance

Image Source: Investopedia